what is a provisional tax credit award

Provisional tax helps you manage your income tax. A provisional credit is a temporary credit issued by a bank to an account holder.

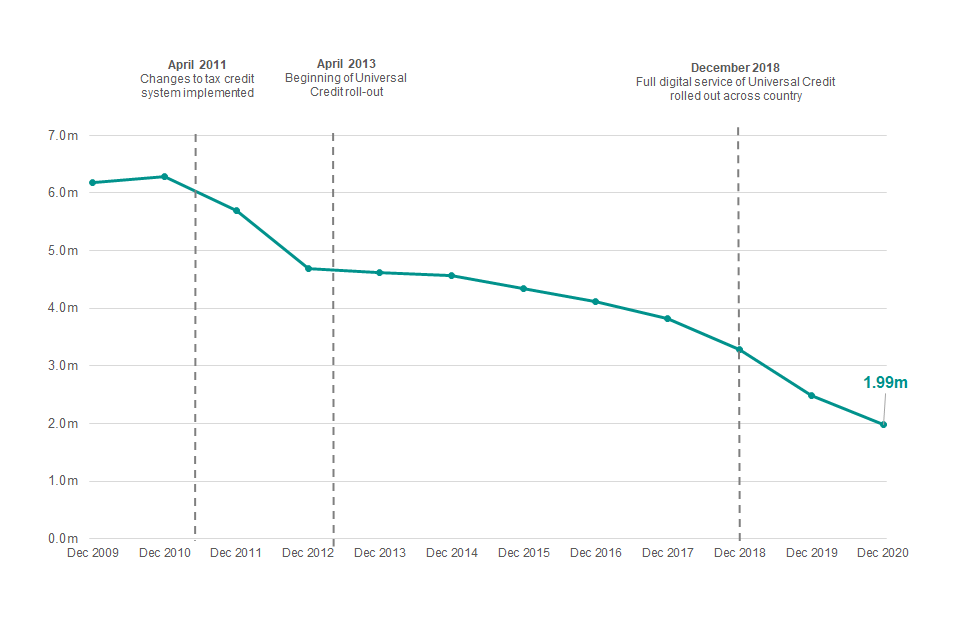

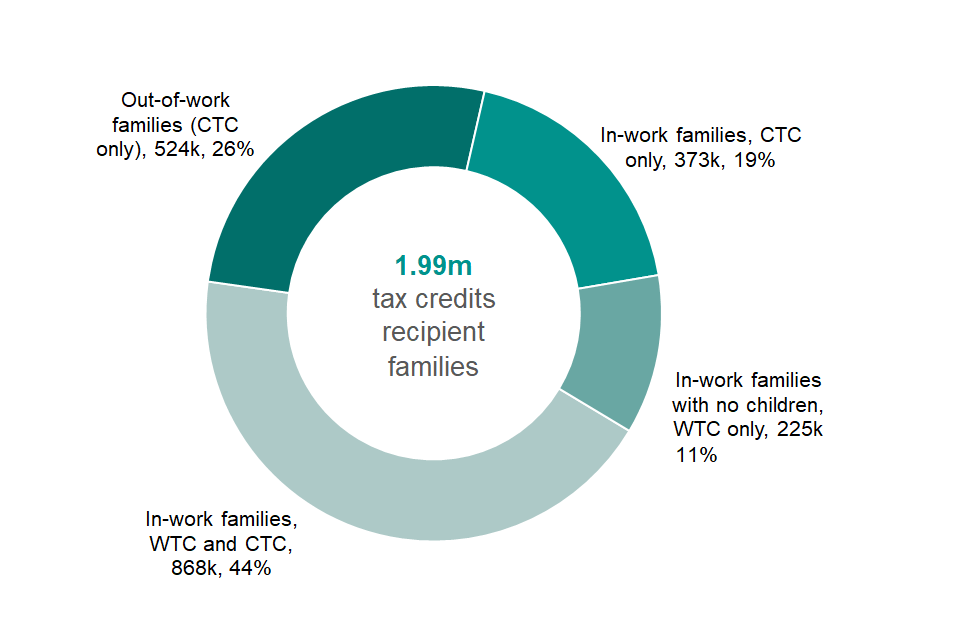

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year.

. Tax credit awards last for a maximum of one tax year 6 April to following 5 April. Provisional tax is income tax you pay in instalments during the year. This publication relates to a snapshot of tax credit.

A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. I recd my renewal around the 19th April i posted it straight back. Tax credits were introduced in April 2003.

When you claim your award is based on your circumstances. Non-Independent tax credit recipients are limited to a cap of 5 million with offsetting state income tax liability and a 5 million cap with offsetting Sales and Use tax liability. Everyone pays income tax if they earn income.

This totals the tax credit at 2500 as maximum. This publication relates to a snapshot of tax credit. Self Employed people rental property owners and people.

What is the renewals process. 02022022 By Carol Daniel Legal advice. The provisional award is based on details you gave them last year or during last year if you updated within the year.

It has nothing whatever to do with the recent renewal you. The purpose of the Provisional Tax Withholding Tax Certificate is to offer documentation of the deduction and as a result to. Some decisions are provisional some final and all formal.

What I am saying is that our authority dont take into account provisional awards of Tax Credits in HBCTB claims from the beginning of each financial year ie. Under the IGST Act input tax is defined as. Provisional Tax Credit Awards Dec 2012 Dimension Assessment by the author Introduction Context for the quality report.

Ad Guaranteed maximum refund. AOTC Amount and Refundable. Youll have to pay provisional tax if you had to pay.

The AOTC is the 100 percent of the first 2000 paid for higher education and 25 percent of the next 2000. Awards based on an income up to 6530 receive their maximum entitlement whereas for incomes above this amount the award is tapered see the Child and Working Tax. Salaries income for the previous year of assessment each deduction provisional tax for that year.

Throughout the tax credits annual cycle there are a series of formal decisions made about tax credit awards. The calculation of provisional salaries tax is as follows. You pay it in instalments during the year instead of a lump sum at the end of the year.

3 000 Child Tax Credit Here S How It Works

Compensation Philosophy Option Reduction Program

Mission Accomplished Or How We Won The War In Iraq The Experts Speak Cerf Christopher 9781416569930 Amazon Com Books

How Do I Renew My Tax Credits Claim Low Incomes Tax Reform Group

Cuna Aacul Leagues Call For Congressional Assistance With Cdfi Fund Issues 2022 09 23 Cuna News

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

Solar And Wind Tax Credits Extended Again Mayer Brown Energy Forward Jdsupra

Ssdi Federal Income Tax Nosscr

3 21 3 Individual Income Tax Returns Internal Revenue Service

What Is The Child Tax Credit Tax Policy Center

Child And Working Tax Credits Statistics Provisional Awards April 2021 Main Commentary Gov Uk

Impacts Of The Final Foreign Tax Credit Regulations Credit Disallowance And Timing Rules

Impacts Of The Final Foreign Tax Credit Regulations Credit Disallowance And Timing Rules

Amazon Com Elder Scrolls V Skyrim Special Edition Ps4 Video Games

Treasury Finalizes Foreign Tax Credit Fenwick West Llp

How Retirees Can Avoid The Tax Torpedo Morningstar

Tax Credit Update Migration To Child Tax Credit For Is And Jsa Claimants By April 2006 Finalising Awards For 2003 4 And Renewals Overpayments And Eliminations Ppt Download

3 21 3 Individual Income Tax Returns Internal Revenue Service